Choosing the ideal legal form is a pivotal decision for any entrepreneur entering the Swiss market. The Gesellschaft mit beschränkter Haftung (GmbH) and the Aktiengesellschaft (AG) both grant limited liability but differ markedly in terms of capital, governance, tax optimization, and growth potential. This in-depth, professional guide offers unique insights, actionable tips, and detailed comparisons to help you determine the structure that best aligns with your strategic objectives.

1. Historical Context and Strategic Implications

Switzerland’s dual corporate framework evolved to serve distinct business needs:

Do you want to start a business and register a company in Switzerland? Please do not hesitate to contact us for a consultation!

- GmbH (LLC): Introduced in the 19th century to empower small enterprises and professional practices with limited liability and streamlined administration.

- AG (Joint-Stock Company): Developed alongside Switzerland’s industrial expansion, enabling large-scale capital accumulation through share issuance and public trading.

Strategic Insight: Your choice reflects more than registration requirements; it signals to investors, partners, and regulators your company’s intended scale and governance rigor.

2. Capital Requirements and Liability Protection

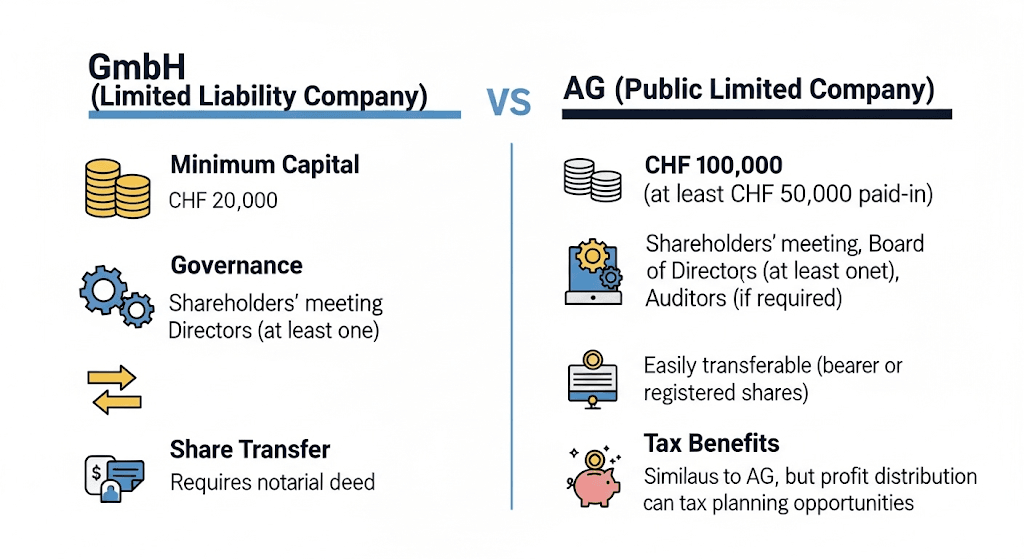

| Attribute | GmbH | AG |

|---|---|---|

| Minimum Share Capital | CHF 20,000 (fully paid in) | CHF 100,000 (CHF 50,000 paid in) |

| Liability | Limited to contributed capital | Limited to contributed capital |

| Reserve Requirements | 5% of profit until 20% capital | Same as GmbH |

| Capital Calls | Possible via shareholder pact | Facilitated by share issuance |

- Unique Tip: For a GmbH, structure a capital call agreement allowing incremental capital injections tied to achieving financial milestones, preserving cash flow while maintaining compliance.

- Professional Warning: Neglecting the legal reserve requirement can lead to personal liability for directors. Prioritize reserve allocations in early budgeting.

3. Governance and Management Dynamics

3.1 GmbH: Flexibility and Privacy

- Management: One or more managing directors appointed by shareholders.

- Decision-Making: Shareholder resolutions—minimum formalities.

- Control Mechanisms: Customize shareholder agreements to define voting thresholds, veto rights, and deadlock procedures.

Expert Advice:

Draft a bespoke shareholder agreement that outlines dispute resolution, transfer restrictions, and exit clauses. Generic templates often overlook nuanced scenarios, potentially stalling critical decisions.

3.2 AG: Formality and Investor Appeal

| Governance Aspect | GmbH | AG |

|---|---|---|

| Board of Directors | Optional | Mandatory |

| Shareholder Meetings | Flexible | Annual General Meeting (AGM) |

| Audit Requirements | Based on size thresholds | Mandatory for larger entities |

| Disclosure Obligations | Limited | Extensive (especially if listed) |

- Institutional Confidence: An AG’s formal structure and potential for public listing signal credibility to venture capitalists, banks, and institutional investors.

- Unique Tip: Proactively establish an audit committee within the AG board—even if not required by law—to streamline future due-diligence and improve reporting transparency.

| Feature | GmbH | AG |

|---|---|---|

| Share Transfer Approval | Notarized deed and shareholder consent required | Freely transferable, subject to articles |

| Ownership Privacy | High | Lower (if shares are publicly listed) |

| Ideal for | Family businesses, professional practices | Growth startups, large-scale enterprises |

- Professional Insight: GmbHs maintain privacy but may face transaction delays due to notarization. Conversely, AGs facilitate swift share transfers via standard instruments, enhancing liquidity and exit flexibility.

- Caution: Restrictive covenants in AG articles must be precisely drafted to balance investor exit rights with founder control.

5. Tax Optimization and Regulatory Compliance

5.1 Corporate Tax Planning

Switzerland’s combined federal, cantonal, and municipal rates range between 11.9% and 21.6%. Strategic canton selection can significantly reduce tax burdens.

Actionable Tip:

Form your AG or GmbH in a low-tax canton such as Zug (approx. 11.9%) and maintain operational substance—office space and local directors—to withstand tax authority audits.

5.2 Participation Exemption

| Benefit | GmbH | AG |

|---|---|---|

| Dividend Exemption | Not available | 95% exemption for 10%+ shareholding |

| Capital Gains Exemption | Not available | Similar benefits under qualifying conditions |

- Expert Tip: Structure shareholding to meet a 10% ownership threshold in subsidiaries, unlocking participation exemptions that significantly enhance post-tax returns for AGs.

5.3 VAT and Annual Compliance

- Companies with CHF 100,000+ turnover must register for VAT.

- Electronic filing is mandatory via the Federal Tax Administration e-portal.

Practical Advice:

Consider voluntary VAT registration for GmbHs with lower turnover to reclaim input VAT on startup expenses, but be prepared for at least a one-year compliance commitment.

6. Growth, Financing, and Exit Strategies

6.1 Capital Raising

AGs excel at attracting venture capital and institutional funding:

- Convertible Bonds & Share Placements: Simplified through AG articles.

- Conditional Capital: Embed in AG statutes to facilitate future financing rounds without altering the articles.

Case Study:

A Zurich-based fintech AG raised CHF 8 million in Series A financing in 2024 by including conditional capital clauses that enabled rapid share issuance upon meeting regulatory approval.

6.2 Exit Mechanisms

| Exit Method | GmbH | AG |

|---|---|---|

| Share Sale | Notarized transfer, slower process | Standard trading agreements, faster |

| Initial Public Offering (IPO) | Not permitted | Permitted (subject to SIX Swiss Exchange) |

| Drag-Along / Tag-Along Rights | Negotiated in shareholder pact | Standard clauses in AG articles |

- Strategic Tip: For both GmbH and AG, incorporate drag-along and tag-along rights to streamline exit processes and protect minority shareholders.

7. Sector-Specific Considerations

7.1 Fintech and Technology Startups

- Regulatory Licensing: Coordinate corporate structure with FINMA licensing requirements.

- IP Holding Entities: Consider AG structures for patent box advantages and R&D incentives.

7.2 Professional Services and Family Businesses

- GmbH Suitability: Optimal for consultancies, legal firms, and family-owned enterprises seeking personal service branding with private ownership control.

Conclusion and Next Steps

The decision between a Swiss GmbH vs AG hinges on your company’s size, funding needs, governance preferences, and long-term ambitions. By aligning your structure with strategic objectives—whether maintaining tight ownership control in a GmbH or leveraging an AG’s investor-friendly framework—you pave the way for sustainable growth in Switzerland’s competitive business landscape.

BMA Business Solutions stands ready to guide you through:

- Comprehensive Swiss Company Registration

- Seamless Corporate Bank Account Opening

- Expert Work Permit Strategies

Partner with us to ensure your Swiss venture launches on a solid legal, financial, and strategic foundation.