Open a Non-Resident Bank Account with Expert Guidance

The Banking Landscape Has Shifted

The days of walking into a Swiss branch with a passport and cash are gone. In fact, regulators now scrutinize every detail, while banks enforce stringent know-your-customer (KYC) protocols. As a result, the barrier to entry has risen significantly.

However, this rigorous private banking compliance for non-resident accounts creates a unique opportunity. Specifically, it ensures that when you do successfully open an account, you are accessing institutions committed to operational excellence and compliance integrity.

Select Your Ideal Jurisdiction

Your choice of jurisdiction determines your financial future. Therefore, we align your goals with the right regulatory framework.

How We Get You Approved (When Others Get Rejected)

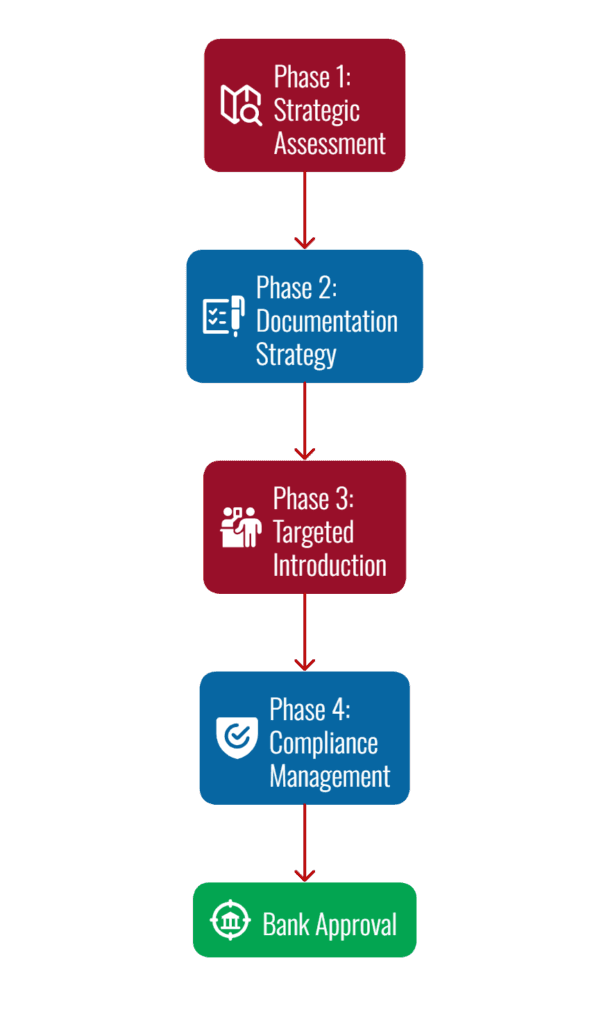

Most applicants fail because they cannot translate their “source of funds” into the format banks demand. To prevent this, we guide you through a proven four-phase methodology.

Phase 1: Strategic Assessment

First, we identify the path of least resistance based on your residency, citizenship, and objectives. A Greek shipping magnate has a different profile than an American tech entrepreneur. Consequently, we calibrate our approach accordingly.

Phase 2: Documentation Strategy

Next, we tackle documentation. “Savings” is not a source of funds. Instead, we help you document the true origin—property sales, dividends, or inheritance—so the narrative is clear. We sequence the documentation to tell a coherent story.

Phase 3: Targeted Introduction

Subsequently, we manage the introduction. We do not mass-apply, which almost guarantees rejection. Rather, we introduce you directly to decision-makers at banks where we know your profile fits the risk appetite.

Phase 4: Compliance Management

Finally, we manage the dialogue with the bank directly. When the bank asks complex follow-up questions, we craft the compliant responses. Thereby, we accelerate approval timelines and prevent miscommunication.

Timeline Reality: Private accounts typically open in 2–4 weeks. Meanwhile, complex non-resident corporate banking setup takes 4–8 weeks.

Detailed Comparison: Choosing the Right Jurisdiction

| Feature | Switzerland | Singapore | Liechtenstein | Monaco |

| Primary Benefit | Capital Stability | Asia Exposure | Confidentiality | Exclusivity |

| Min. Deposit | ~$500k | ~$2M | ~$500k | ~$3M |

| Best For | Wealth Preservation | Business Expansion | Asset Protection | Premium Private Banking |

Security and Asset Protection

“Is my money safe if the bank fails?” Yes. For instance, in jurisdictions like Switzerland and Liechtenstein, your investment securities are classified as segregated assets (Sondervermögen). Crucially, they do not belong to the bank and cannot be seized to pay the bank’s debts. If the bank fails, your portfolio is transferred to another custodian entirely intact. In addition, Monaco protects cash deposits up to €100,000 per depositor under EU standards.

“Is this for tax evasion?” Absolutely not. The secrecy era ended in 2017 with the Common Reporting Standard (CRS). Since Monaco, Switzerland, and Singapore all participate in CRS, information is exchanged automatically. Therefore, we use non-resident banking for legitimate strategic purposes: asset protection, currency diversification, and investment access.

Frequently Asked Questions: Navigating Non-Resident Banking

You have questions about compliance, logistics, and privacy. We have the answers.

Secure Your Financial Future Today

Regulatory requirements are growing more sophisticated, and capital controls are tightening. Thus, the time to establish a properly structured non-resident banking relationship is before you need it, not after.

Ready to move forward?

(Confidential. No obligation. Strategic guidance tailored to your profile.)

Related publications

Opening a Swiss Bank Account from the UK: A Comprehensive Guide for 2025

The increasing interconnectedness of global finance has led to a surge of interest among UK…

Experience Sharing: Opening a Bank Account in Switzerland

Opening a bank account in Switzerland is often seen as a strategic decision for those…

How to Open a Swiss Bank Account as a foreigner: Your Insider’s Guide for 2025

Introduction: Why Switzerland Still Beckons in 2025 For generations, Swiss banking has stood as a…

The Ultimate Guide to Swiss Bank Accounts for UK Expats: Navigating Tax and Residency Rules

Swiss Bank Accounts for UK Expats: Unlock Financial Security Abroad Introduction: Understanding the Benefits of…

The Ultimate Guide: How to Open a Swiss Bank Account for Free in 2024

Swiss bank accounts have long been synonymous with financial security, privacy, and exceptional service. Traditionally,…

Swiss Banking: Your Passport to Financial Security as a Cyprus EU Citizen

Introduction: Unveiling the Path to Financial Peace of Mind Are you dreaming of the unparalleled…